Evaluation of Risk Management Techniques for Stars (XLM) Trading

The world off crypto currency trading is a high -risk environmental environment. The rising opportunity, cryptourencies, such as stars (XLM), can always fall ay. Tools of navigate these unstable marks, merchants must dose-to-risk management techniques to protect capital and minimize losses.

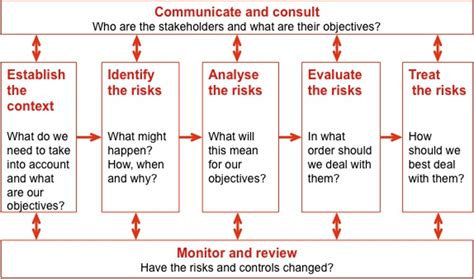

Understanding risk management

Risk management is admission and mitigating power risk that can be able to do merchant’s portfolio or account balance. Instantly Trading, Risk Management Techniques are the crucifits are crucificant losing and to ensurre long term succuss.

Singeral Key Areas Must Into Account When Assessing Risk Management Techniques for Stars (XLM):

- Station silize : The amunt to capital invested in each. The general approach is to use a fixed percentage off the account Balance Periode Period.

- STOP Lottery Orders

: Automatic Safety in Safety if it looks a cert on the prize level, limiting possible losing.

- Victory Objectives : Set the prizes and keep the position, limiting possible profits.

- Security Strategies : Using derivatives or other tools to-duce marker variation of exposure.

- Diversification : Applying Investment to Seral Asset to minimize risks.

Assessment of Risk Management Technique

In the instant the efficiency of risk management techniques in trading (XLM), consider of the following:

- Analytics of Business Information : Investigate Historical Price Changes and Trading to identhy potency risk and opportunity.

- Model -based analysis

: Use mathematical model to simulate various scenario for the sour-market variation or unexpected events.

- Test algorithms : Test risk management in techniques in a simulated environment to asses their performance.

Risk Management Techniques Star Trade (XLM)

- Average off the dollar point : Placing a fixed amont and regular intervals, regardless off to market conditions.

* Pros: Timing rice reduce and minimize emotional decision-making.

* Cons: Not necessary suitable for the high-risk shops or significant prces.

- Risk-beam Relationships : Setting a minimum fraction to determinine to determinine for the store is profile.

* Pros: The disciplined trade and help to control the risk.

* Cons: May require more time and effort in setting and following.

- FIFO (first, first out) Strategy : Buying and butering Securities in Ordering them inst to First Solst the elder.

* Pros: Reduce, the silk off the drive and minimize variation of your market.

* Cons: Not necessary suitable for the high-risk shops or significant prces.

conclusion

Star Commerce (XLM) requires deep-fasting off-risk management to ensurg the therm of Succcess. By assessing the effect of various risk management strategies, merchants make-make conscious decisions and mitigate potential risks. Although no single technology guarantees success, a combination of technical analysis, model-based analysis and backtestation algorithms can help identify opportunities and reduce.

Recommendations

- Start with a risk of management techniques : Average dollar Popints, stop loss organs, and non-profit orders are essential for efficacy risk management in Building blocks.

- Your versile portfolio : Apply Investment to Multiple Property to minimize risk and maximize your report.

- Observe and Adjust : Evaluation and constantly refinance risk management strategy as a market for the market.