Unlocking the power of cryptocurrency trading with technical indicators

The world of cryptocurrency has been developing rapidly over the past few years, and prices have changed wildly due to the complex dependence on factors such as marketing, economic indicators and regulatory changes. As a salesman in this very unstable space, it is necessary to have a solid trade strategy that can help you move in these fluctuations and maximize phrases. One of the most powerful tools available is technical analysis, using specific technical indicators to improve the decision -making process.

Understanding technical indicators

Technical indicators are mathematical calculations used to analyze chart patterns and provide insight into market behavior. They can be divided into heavy categories:

- Medium walking : simple movable (SMA) and interpretation medium movable (EMA) will help identify the direction of the trend, calculate the levels of support and resistance, and detect potential buy and sales signals.

- Transfer indicators : These indicators use the latest data to update the previews, such as the relative force indicator (RSI), stochastic oscillator (STO) and the divergence of medium movable convergence (MacD).

- Variable indicators : option variability indicator (VOL), indicator based on range (RBI) and implied variability (IV) Help the mood on the market and an appetite at risk.

- Bollinger ranges and other indicators related to trends, such as the real range (ATR) and Bollinger (BS).

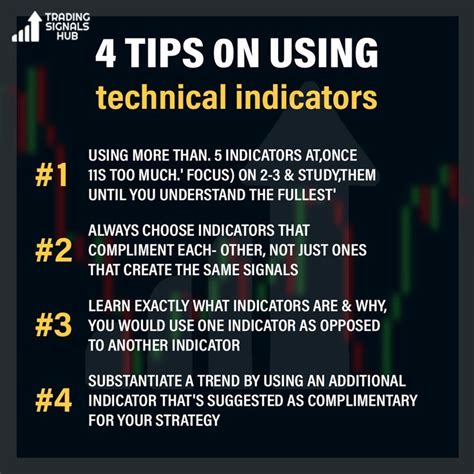

Using technical indicators to improve trade strategy

When it comes to cryptocurrency trade, technical indicators can be particularly effective in identifying potential purchase and sale signals, predicting price movements and optimization of risk management. Here are some ways to use technical indicators to improve the strategy:

1.

- Specify price levels

: Technical indicators such as Bollinger and Medium Moving Bands will help us indicate price levels and resistance, enabling us to set orders to the degree of alloy and limit our exposure to potential losses.

3.

- Optimize risk management : Using indicators such as variability and RSI indicators, we can identify situations in which the market is purchased or sold out, enabling us to properly adjust the size of the position and level of risk.

Example: using an average movable convergence (MACD)

The MacD indicator is a popular technical tool used on various financial markets. It measures the difference between two movable average in different periods and can be used as follows:

- When the MacD line crosses the signal line (SL), it indicates a potential buy signal.

- And vice versa, when the MacD line passes below SL, the signal indicates.

Here is an example of how you can use this indicator in your trade strategy:

- Set the chart with a 12-person straight movable (SMA) and 26-speed EMA as the main indicators.

- Use a 30 -day time frame for analysis.

- Enter the purchase signal when the MacD line crosses SL, signaling a potential level of growth.

- Continue monitoring the chart and adjust the size of the position based on the changing shoot.

Application

Technical indicators can be a powerful tool in increasing trade strategy and navigation around the complex world of cryptocurrency markets. Understanding how technical indicators work and effectively use them, you can increase your chances of creating information and maximizing phrases.