Cryptocurrency Price Action Strategies for Trading Litecoin (LTC)

The world of cryptocurrency trading is increasingly popular, with many investors seeking to capitalize on the rapid growth and volatility of the market. One of the most significant cryptocurrencies in this space is litecoin (LTC), a peer-to-peer Electronic Cash that aims to be faster and more efficient than traditional fiat currencies.

As a Digital Currency, Litecoin’s Price Movements are heavily influenced by various market participants, including traders, investors, and institutional investors. Smarties for Trading Litecoin using technical indicators and other tools.

Understanding Litecoin (LTC) Price Action

Before diving into the strategies, it is essential to understand how Litecoin’s Price Behaves in Real-Time. Here are a few Key Characteristics of Litecoin’s Price Action:

.

.

* Support and Resistance Levels : Litecoin’s Price has several key support and resistance levels that traders should be aware of.

Price Action Strategies for Trading Litecoin

Now that we have an understanding of Litecoin’s Price Action, Let’s Explore Some Effective Price Action Strategies to Trade This Cryptocurrency:

- Trend Following Strategy

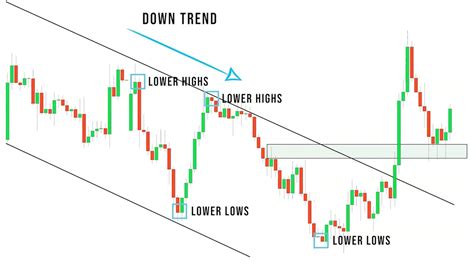

Use a trend following following approaching the direction of Litecoin’s Price movement. Look for Clear Support and Resistance levels, as well as potential reversal patterns. When the price breaks through a strong level, it may be indication that the trend has changed.

Example: If Litecoin’s Price is currently trending upwards, and it reaches a high near $ 190.00, you may consider buying at this point to capitalize on the upward momentum.

- Range Bound Strategy

Traders who preferred strategies will focus on identifying areas of support and resistance within Litecoin’s defined ranges. When Prices Enter these ranges, traders can buy or sell at specific levels.

Example: If Litecoin Enters and 10-Day Range (e.g., $ 240.00 to $ 250.00) with a high near $ 245.00, you may consider buy at this point if the price continues to rise.

- Candlestick Pattern Trading

Litecoin’s Price Action can be analyzed using various candlestick paterns. Here are some popular ones:

* Hammer (a bullish reversal pattern): If Litecoin’s Price Reaches a High near $ 200.00, and then falls back to $ 190.00 before the 20-Period moving streamage, it may indicate a potential buy signal.

.

Example: If Litecoin’s Price Reaches a High near $ 200.00, and the 20-Period Moving Average Crosses below this level, you may consider buying at this point.

- Moving Average Crossover Strategy

This The crossover between two moving levels is an important indicator of momentum changes.

Example: If Litecoin’s Price Crosses Above the 50-Period Moving Average, it may indicate a potential Buy Signal. Conversely, if it crosses below the 50-Period moving acrossage, you may consider selling at this point.

- Dip and place strategy

This

Example: If Litecoin’s Price Dips below $ 150.00 and rises back up to $ 155.00, you may consider buying at this point if it continues to rise.